The Walsky Difference

The Walsky Difference

For over 23 years, Walsky Investment Management has been helping individuals and families invest for the future by offering professional investment services that focus on creating individual stock portfolios. Our clients have a one-on-one relationship with their portfolio manager. Our clients know what they own, why they own it and are kept informed of any changes in their portfolio. This enables us to customize each client's portfolio to help them plan for the future, whether it is saving for retirement, or buying a new home. Unlike other investment firms that only offer mutual funds, ETF's and a myriad of non-investment related products, we are focused on investing for our clients and not about selling products or services they may not need.

At Walsky, we offer one-on-one service. Our clients meet regularly with a dedicated professional that is available to them to answer any question that they may have about their portfolio and help them with any transaction. It is a level of service that has become less common in the industry but is found each and every day at Walsky.

What Makes Walsky Unique

We are passionate about investing and providing our clients a level of service that is based on trust, honesty, respect, integrity and a commitment to always placing the client first. It is this dedication for investing that has earned Walsky the reputation of being the company that investors trust.

What makes Walsky unique is our level of service. Clients work with dedicated professionals who gets to know them and are responsible for helping them address any need that they may have about their account. Regardless of the issue, one phone call is all that is needed to get help.

Our Philosophy

Investment Style

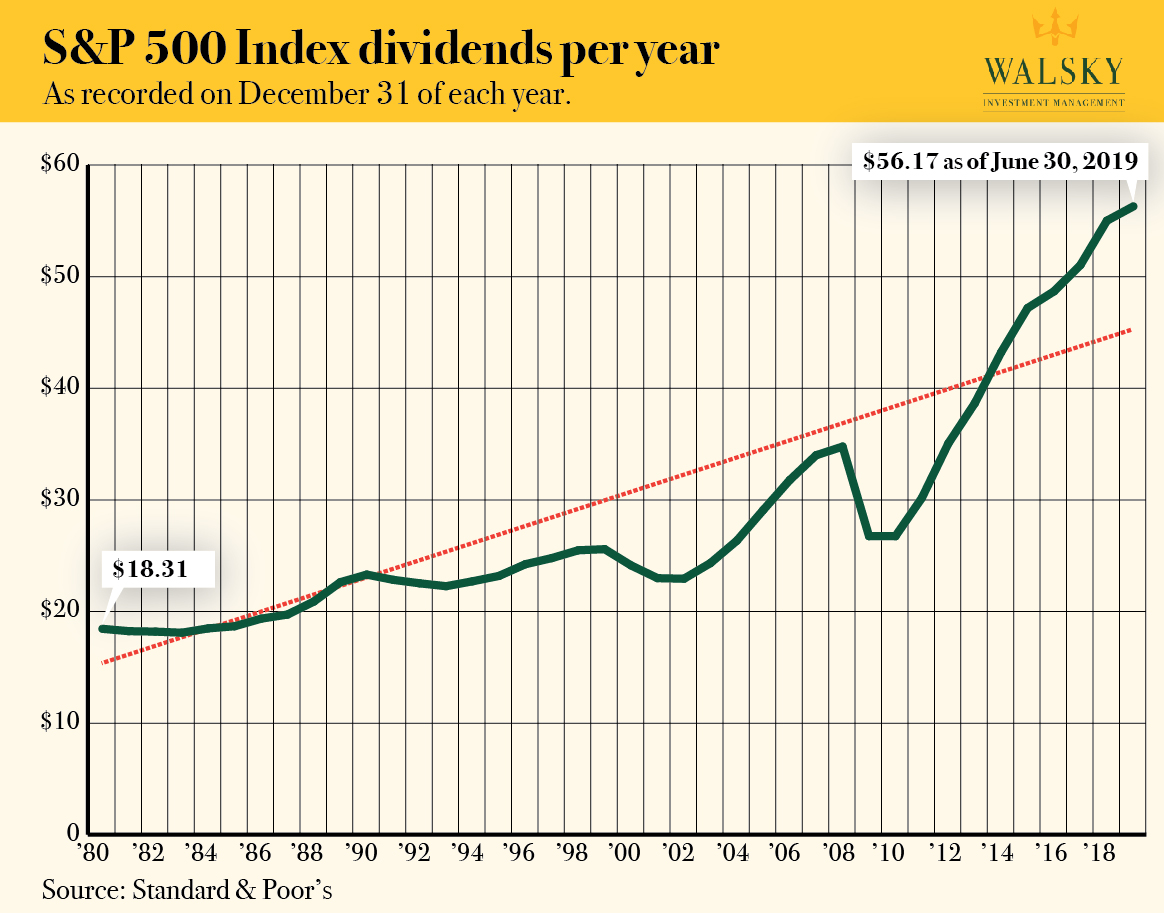

At Walsky our emphasis is on investing for the long-term. We realize the importance of dividends, which provide earnings to stockholders and at the same time minimize downside risk. Our clients' portfolios consist mainly of common stocks of companies with consistent dividend growth.

The remainder is invested in fixed income vehicles such as U.S. government bonds, corporate bonds, certificates of deposit and money market funds. We believe that this investment style affords lower risk without lowering the appreciation potential that makes common stocks attractive.

How is Walsky different from a mutual fund?

Walsky Investment Management, Inc. is a registered investment advisory firm that creates individual portfolios for each client based on his or her needs. A mutual fund, on the other hand, is a portfolio of stocks in which a group of investors mutually invest and receive shares of ownership. There are thousands of mutual funds and their management can change over time. The fees that mutual funds charge have become a concern of investor groups and investment journals that have noted the fees may be excessive. At Walsky, there is only one fee and the fee is clearly identified to the client.

The portfolios that we create are diversified and include many sectors of the U.S. large-cap equity market. Each portfolio differs in asset allocation based upon the client's requirements and risk tolerance. By managing each portfolio independently, we ensure that our clients have investments that are appropriate for them.